New Highs In the S&P 500?

S&P 500 Elliott Wave Chart Analysis for Day Traders and Swing Traders. I'll also be covering Gold Futures and Crude Oil Futures too. Is the B Wave Over? Or are we going to make new highs?

Will the market CRASH again?

The S&P 500 had a very steep correction recently which you could call a MARKET CRASH. The question is… Will we get ANOTHER crash? That’s what I’ll be looking at in my video using Elliott Wave for my Technical Chart Analysis of the current stock market.

S&P 500 Elliott Wave Analysis of Trump... China, You're Fired!

Wow, what a week!

Trump Tweets and the market goes wild! I don't know, maybe it's time for me to sign up for a Twitter account??? Nah!

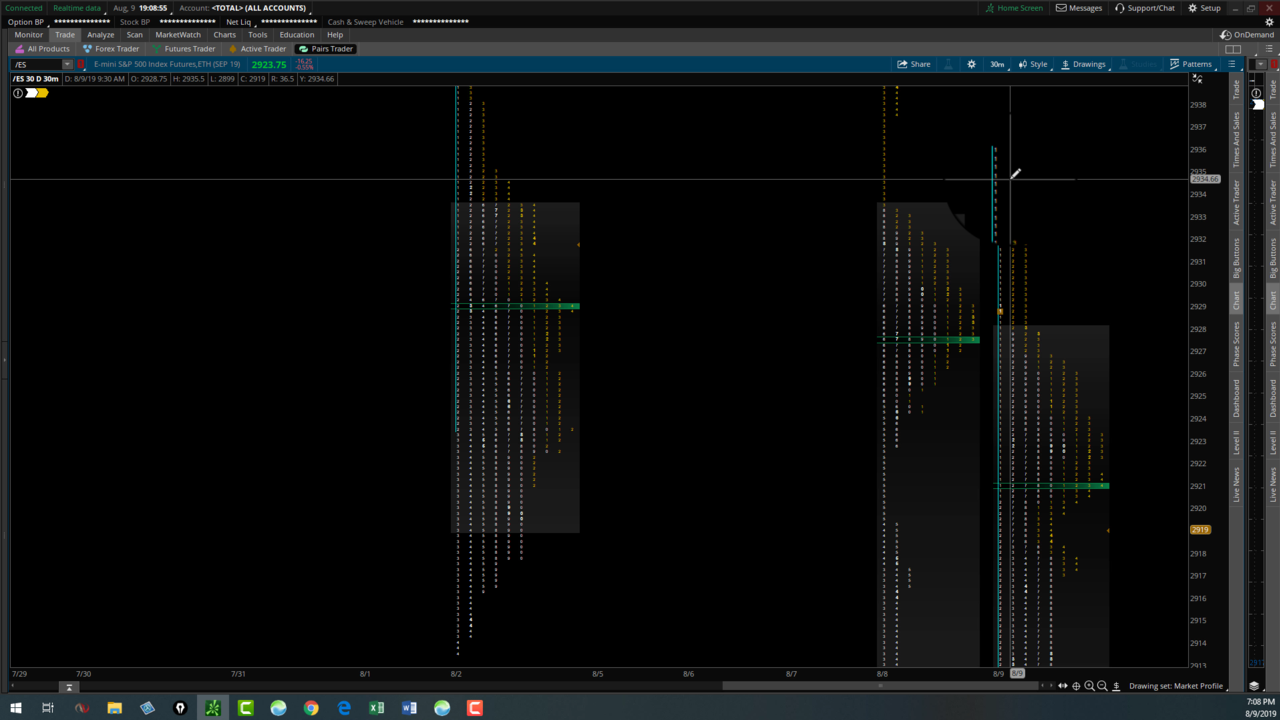

Well, the market had a lot of back and forth this week - trapping both longs and shorts. There were some pretty good trading opportunities... Of course, there is usually more opportunity when there is volatility. The VIX has been ranging between 16 and 23. Not explosive volatility but better than when it was hanging around 12.

In this week's video I cover Elliott Wave, my bullish count and my bearish count - which one I'm leaning more towards. I also am reviewing the Market Profile Charts and what to watch for on Monday.

S&P 500 and the Inverted Yield Curve - Recession Coming?

New Workbook - https://bit.ly/2Zl105d

Sign up for weekend updates - https://bit.ly/2KuRZSp

Hi, thanks for checking out my analysis of the S&P 500. This week I'm going to see how the 10 and 3 Year Bond Yield Curve relates to the S and P 500. Are we headed for a Recession or is the Yield Curve a Broken Barometer? (Inverted Yield Curve) Today, I'll be using Elliott Wave Theory as well as Market Geometry to give my an idea of what the market is doing. If you're a day trader, swing trader or scalper I hope that this video on the SPX and ES Emini Futures contract will just give you another way to look at the market. Another point of view. I give two scenarios - One for a Bull Market and one for a Bear Market. Please share if you've find this helpful and leave a comment.

Don't forget to check out my new workbook here - https://bit.ly/2Zl105d

TEST Your Trading System and Knowledge with the Traders Test!

https://bit.ly/2Zb69zT

Thanks for watching!!!

Was the Bull Market Over on July 26, 2019? S&P 500 Update

New Workbook - https://bit.ly/2Zl105d

Sign up for weekend updates - https://bit.ly/2KuRZSp

Hi, thanks for checking out my analysis of the S&P 500. I'm using Elliott Wave Theory as well as Market Geometry to give my an idea of what the market is doing. If you're a day trader, sing trader or scalper I hope that this video on the SPX and ES Emini Futures contract will just give you another way to look at the market. Another point of view. I give two scenarios - One for a Bull Market and one for a Bear Market. Please share if you've find this helpful and leave a comment.

Don't forget to check out my new workbook here - https://bit.ly/2Zl105d

And sign up for weekend updates here - https://bit.ly/2KuRZSp

Thanks for watching!!!

How To Trade Major Market Tops

In this video, I go over my thoughts on trading market tops using the S&P 500 Emini futures contract. Are we currently experiencing a Major Market Top and how to trade tops in general. I'm using Elliott Wave theory to help in the market analysis. I hope another view of the market is useful to you and I hope you share and like this video. Thank you. DisciplinedTradingDecisions.com

Part 2

S&P 500 Analysis

Here's a short video with my analysis of the ES Futures Contract

Review of the day's action in the ES 4-18-16

We're taking a look at todays Market action with traditional charting and Market Profile

Analysis of the S and P 500 ES Futures Market

Sunday Evening Analysis of the ES Futures Market and detailed Market Profile